Unicorns and Keynesian Economics

My youngest daughter is four and still a bit scared of the dark, so she likes to keep a stuffed unicorn named Corny Corny with her when it’s time for bed. It’s a big round tie-dye pillow like blob with a unicorn horn and two stiched on happy eyes (see featured image). Corny Corny gives her security when it’s time to go to bed because she can grasp onto this soft unicorn when she looks out at her shadow ridden bedroom, and know, that despite the cold mystery of the shadows, there’s one thing that’s certain. She has a soft warm Corny Corny to hold onto.

I too have a unicorn to keep me safe from the shadows of uncertainty in my life. But my stuffed animal is a high savings rate and the accompanying monetary sums that start to build up after some time. It feels damn good to clutch this high savings rate when I look out at the unknowns of life. When we save, we give ourselves something solid to hold onto, whether that’s more money to invest or just the peace of mind of knowing that we don’t “need” this week’s paycheck, or next week’s, or next week’s…that knowledge feels good.

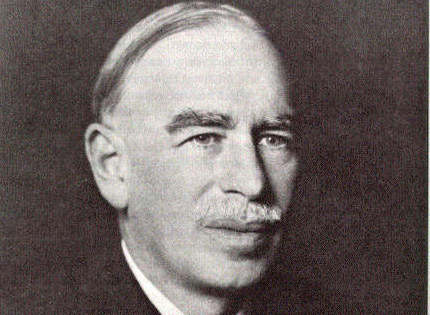

The further I find myself falling into the abyss of this personal finance mine shaft, the more I seek to learn the overall framework that allows this saving and investing to happen. So my mind has wandered a bit from the save and invest mantra that is the heart of financial independence and towards the past. Towards the policies that have allowed our western democracies to thrive in the years after the strain of the Great Depression and Second World War. The policies that fell out of favor and were forgotten during the stagnation of the ’70s, but that came back to save us in 2009, and again in 2020. This is where I found Keynes. The king of spending.

the unicorn vs the keynesians

It’s inherent in Personal Finance writing and podcasts that we try to spread around the natural high that saving money creates. When our financial house is in order everything else becomes easier to deal with. Saving more and spending less is a good message to spread. It improves lives. Everyone should have this stuffed unicorn to hold at night.

What if the majority of the households in our country suddenly got the urge to get a high savings rate? Wouldn’t that be a good thing for society? Wouldn’t stock market volatility dissipate as everyone started pumping up to half their paychecks into the market with a buy and hold mentality? The price for things might drop as demand for unnecessary and luxurious goods slowed. Employers would have to raise wages to keep a less enthusiastic workforce employed longer. And imagine all the entrepreneurs and artists that would sprout up as people were freed to pursue their passion projects.

Utopia, right?

Well, no. That’s not what would happen. FIRE is actually bad for the overall economy according to a popular economic theory. If everyone decided to pursue financial independence it would wreck the possibility to FIRE for everyone.

There’s a term for this and it’s called the Paradox of Thrift. In short, this theory, popularized by a rockstar British economist John Maynard Keynes, states that an individual’s high savings rate hurts the economy. The belief is that demand and consumption drive supply. When consumption levels are low, so follows unemployment. When we don’t spend our money, say by getting our regular haircut, it hurts our barber. And so this barber would, in turn, spend less money because he or she isn’t getting our tips and business. This induces a “less spending” spiral of death (recession). It’s a domino effect on the economy…if you believe in this Keynesian theory.

In other words, what’s intuitively good for the individual is not good for the general population in which the individual resides, therefore hurting the individual and creating the paradox. Demand drives the economy, according to Keynesians. It’s all about demand. And spending.

So are we collectively hurting the economy by pursuing Financial Independence through living frugally with high savings rates? Does this in turn rob the ability of others to pursue their own financial independence?

As an investor, we need others to spend and indulge so that we can reap the benefits and gains of the businesses we’re invested in. As an owner of DIS, I want those amusement parks packed, I want Disney Plus streaming into every household, mickey mouse decals on the back of every car window. I don’t want Disney fanatics to suddenly embrace FIRE and cancel their season passes and streaming services. I mean, good for them if they do it, but who’s going to keep my investment in Disney profitable then?

We want it both ways right? We see the joy of what being Financially Independent means and want to spread this joy, yet we need to let others spend so our investments can grow. A paradox. The FIRE Paradox.

paradox of thrift and the paradigm of FIRE

So what does Keynes have to do within our own unique and individual universe of saving and spending and financial independence? His theories had to do with big picture economics or macroeconomics; not what each of us does on an individual level.

The idea that spending is a good thing is at the opposite end of the spectrum where those who are using a high savings rate to build wealth live. So do we ignore the possibility that this theory is correct because it might not fit in with our line of thinking? Can we admit to ourselves that our high savings rate, as wonderful and stuffed unicornish as it might be, might be hurting someone?

Mr. Keynes can give us a different way to think about spending our money. If we shrink down his theory so that it fits into our lives, we can see that when we spend it can be a source of water to the economic garden around us.

Personally, I’ve struggled with spending, even on cheap trivial items, because I’m trying to save as much as I can. It can feel as though I’m hurting my future self when I spend. But if I can think of spending as a source of good that we can share with others, it makes it a lot easier. Keynes was also a rebel in the same way that those of us pursuing FIRE are rebelling against the system. His ideas were not taken lightly when he first published his famous book. But as they caught on, they pulled nations into the so called Golden Age of Capitalism, allowing us to have the quality of life we enjoy today in western countries.

As much as Keynes has become a controversial figure over the years, I think those of us who are pursuing some form Financial Independence have more in common with this man than we might think. It doesn’t matter much if you agree with his overall economic policy. The point is we are living in a world shaped by his ideas. When the world is in economic crisis mode, you will hear his name again.

strategic spending

We eat out a few times a month at local restaurants. I buy coffee during work when I take my morning walk to stretch my legs when I could easily grab from the break room for free. My wife chooses to pay more for a local gym rather than a cheaper chain gym. And really, we shell out $6k a month on bills. The majority does go to corporations, but regular folk work at those corporations spread out across the world. If I make a conscious and mindful choice of where I spend, it doesn’t feel like my money goes into a void like my tax money tends to do. Every single dollar that leaves our household is a choice we’ve made. It says who we are.

If there’s a choice between big business and small business, I’ll happily take my business to the local owners who live in the same community as me. One of the benefits of having a high savings rate and embracing frugality is that we can afford to spend a little more on some things in order to support a local business. Saving money is great, but my life cannot revolve solely around the dollar value of things.

We don’t have to worry about the masses one day all deciding to pursue FIRE with high savings rates. Why? Because FIRE is damn hard to do. It goes against the grain of our consumer culture society. The groupthink is strong. And the group wants to spend on shiny new things to brag about. Those who turn into the wind are rewarded.

That’s not to say a deflationary recession wouldn’t spur the Paradox of Thrift to take form as it did during the Great Depression, Great Recession, and over the years in Japan.

And even if everyone did suddenly start to save and churn the economy into recession by a lack of consumption like Keynes would suggest would happen, I have my high savings rate unicorn to hold onto till the storm is over.

How much consideration do you take when it comes to where you are spending money or giving companies your business? When are times that you will spend more money than you have to on something?

Discover more from Happily Disengaged

Subscribe to get the latest posts sent to your email.

22 thoughts on “Unicorns and Keynesian Economics”

we definitely spend more than necessary on a couple of local businesses. we could save on wine but choose to support a friend’s shop almost exclusively and we shop mostly at a regional grocery chain. we otherwise don’t spend much except on vacation but i have never been to a costco and have not been inside a walmart in about 15 years.

you are right about that security blanket of invested money. it’s a really big deal to take away that money stress.

I love that you havent been to Walmart in 15 years! I don’t go either but its more cause its far away. Every time I’m at a costco I’m astounded by the lines and the carts stacked high with goods. Each customer is dropping $250 minimum it seems. They do a great job at luring and setting the hook at that place.

Yeah it took some time for me to find my spending balance. I really find that if I think out where my money goes, it hurts less when I spend. Nothing like a grown man with a security blanket…or stuffed unicorn!

I always think, that investing is also buying – buying shares. You go from the consumer side to the capitalist/business owner side. And you take the risk of this and are payed for it – dividends. Those people, business owners (now you too), are important for the society as well. If nobody would be willing to take the risk (for a new product for instance), there would be no new and maybe better or more resouceful product. So I do not see, how we can be bad for our society. We do good from an other angle…

Hey Silke, great perspective. I agree that buying is buying, and buying shares is much savvier than supporting a company through a product or service consumption. This is what happened recently here in the US with all the retail investing during the shutdown…though it took government “spending” to keep us afloat here. I also agree with your sentiment about moving from consumer to owner class…that should be our end game as an investor.

But buying shares can’t be our sole contribution to the economy, nor can it ever be: we have to eat and will pay taxes. A company can’t survive solely off share valuations raising either, let’s look at AMC or recently gamestop…the outlook for those companies isn’t good despite droves buying shares. Overall I agree, we do good from the angle of the owner. That’s the best angle.

Appreciate your thoughts. Thanks for commenting.

Some interesting things to think about here. I read a lot about economics, though I have no background in it, because I think it’s so interesting. I just read “The Deficit Myth” by Stephanie Kelton, all about Modern Monetary Theory, and it really changed the way I look at spending. As you mentioned, every dollar that I put into circulation via spending is a benefit to someone else, be it a small business or a large corporation. We take a hybrid approach when it comes to the recipients of our spending. We overspend on quality, local food, and go to farmer’s markets pretty often. But we also do our bulk shopping at Costco (sorry Freddy!). Costco is well known for being an excellent place to work (I actually know many people who are employed by Costco), and so I have no misgivings about spending money there. I also think you’re right, we don’t have to worry about what would happen to the economy if everyone FIRE’d, because that will never happen. Good for us, I suppose!

I’m reading more and more about economics as well. I don’t have a background in it either but I find the more I read about it the more captivating it is (I’m the same way with history). I’ll check out that book you recommend, I love books or ideas that can change the way you think about something you do every day. We’re the same over here about shopping at Costco. We save a bunch by shopping there, though sometimes it doesn’t feel like it while I’m putting a fifty pack of toilet paper in my cart. We spend more on food too. The discount grocers in my area don’t have the best produce or fresh protein. Yeah, FIRE is a tough sell to anyone, which keeps the winds in our favor.

Thanks for commenting!

Great article, Noel! Yep, I like to playfully poke fun at profligate consumers, but always acknowledge that I need them for continued FI. As for me, I do give thought about my spending and generally default to the small, local or indie vendor. This is easy to do particularly since I live in a rural area. When I do patronize megacorps they are those that I own like Apple, Home Depot and, yes, sometimes even McDonalds.

I also agree that my brokerage accounts provide a genuine sense of Corny Corny security during those times when the lights are low and things go bump in the night 😀

Thanks Mr Fate. It’s hard not to judge those guys out there dropping money like there’s no tomorrow. What makes it worse, is that I used to be one of those spenders. Once the “red pill” has awakened the FIRE, everything is viewed through the personal finance paradigm. This is why I think the paradox of thrift catches my attention every time I read about it. Man, I bet it’s easy to feel good about spending when you’re in a rural area and your choices are limited to those who really live around you. In a bustling city, it’s easy to lose sight of spending and fall into the cheaper is better trap, I’m sure you’re well aware coming from Socal. I try to spend at “my companies” as well, this is what makes me feel good when I get dragged to the consumer culture apex of Disneyland lol.

Yeah nothing like a cuddly Corny Corny to make things better. Thanks for stopping by.

You are what you spend, right? Hahaha.

I enjoyed this topic and it’s ironic that my post for tomorrow ties into it nicely. Funny, how we all kind of think along the same lines. I like your angle from the thrift point of view on FIRE. My main point is, would the world really be a better place if everyone was financially independent? You go into the details of why it would probably never happen while I play it out a little more for fun.

Buying can be a tricky thing sometimes. I see a lot of people that are gung-ho on ESG and the environment but buy index funds – essentially supporting all the companies that they despise. I’ve always believed that people see what they want to see. If an action, doesn’t fit their internal narrative, then they simply change the story they are telling themselves rather than altering the action. But to each their own.

Spending-wise, I try to support local businesses. This mostly happens with restaurants. But if there is a huge price discrepancy on big ticket items, I’ll probably lean toward the better deal regardless. Gotta call a spade a spade.

Another good post for the thinking man bud.

So true. I like that saying. I’ve read and heard sentiment like that before, but it’s only recently that I started thinking more about what my spending says about me.

Cool, I’m looking forward to reading your new post. I’ve mused quite a bit about how life would be if everyone decided to become FI. It’s a fascinating concept that can go many ways. I like when we can stretch reality a little to place humans in difficult or rare circumstances and see how it plays out, hence why I love sci-fi and fantasy books so much. We do think along the same lines. I guess that’s a natural occurrence within a community, the “groupthink” of the personal finance blogging community.

People do see what they want to see. I’ll be the first to point to myself when it comes to owning companies that I disagree with on some levels. Amazon and Cintas being the first to come to mind for labor practices, and others for environmental reasons. Yet I own them. And owning VTSAX, I pretty much support every company, good and evil, on some level. If getting to FI at a decent age is the end goal, this is the route one must traverse.

I like your spending stance. Most of my money going into the community is through food as well. If I drank, then I’d support the local wineries and breweries.

Great comment Q-FI. Always appreciate your perspective.

I have often thought about what if more people followed the path to FI and RE. How would it work in our society but from a logistic point of view? If a majority of people are retiring early, who would be the unlucky ones still stuck at work? Maybe once they saved up enough money, it would encourage people to do things they enjoyed more instead of being stuck at a job they hate for their whole life.

But you are right, following FI takes a lot of effort and a lifetime of dedication. Most people can’t even follow a diet for more than a few weeks!

That’s probably the biggest question if FIRE became mainstream. Who would keep on working and for how much? I’m sure wages would skyrocket to try to keep employees on board for as long as possible…maybe this would push the next technological revolution towards robotics and AI. I think the human need to try to have more than others as a sign of status will always keep the majority of people away from the FIRE lifestyle. You’re so right about the dedication part. The path of least resistance will always be the path most taken.

We all have our stuffed unicorns! The key, as you mentioned, is strategic spending. If you spend your money intentionally and purposefully, it really doesn’t feel like spending at all. The problem so many consumers have is in not knowing where their money goes. Even with an education on FIRE principles, it’s still easier said than none for most.

That’s right! Yes spending is the first step and key to financial freedom, it tells the story of who we are and what we value…probably more accurately than we could verbalize. Discipline is a scary tough pill. Summed up FIRE is really about mastering discipline and dedication the income and investing is the easy part.

Well, we did have a period of time when the savings rate surged in Spring and early-Summer of 2020 during the pandemic. Stock market volatility surged though because people were at home trading.

That’s right. Thinking about that was part of the inspiration for this post. The market did keep going up…choppy, but up. The spike in savings was offset by massive government spending to keep the service side of the economy afloat. I imagine Keynes would have approved of the government response to the times.

Well said. As I moved to a more suburban town, I make a conscious effort to support local shops when possible.

Interestingly enough, everyone has the “things” they like to spend money on or prefer to spend money on, moderation is key.

At the end of the day, they just become more digits on the screen. Saving/investing/living below your means will always being the key tenets of personal finance, but where on the spectrum one lies is a personal and subjective choice.

Thanks for stopping by Adam. I’m the same in that when I get away from urban areas it’s easier for me to spend mindfully. Maybe it’s the hectic rush of the city that makes me just lock in on the lowest price and jet out of the stores.

Good point. The “things” that I spend more on are usually hobby-related…and of course vacations and things for the kids. But even then, it’s a mindful and strategic choice and hardly ever impulse buying. That’s right, our money numbers don’t mean much…till we decide to drawdown. Saving more and spending less helps me sleep better at night and takes away the anxiety of the unknown future. Thanks for taking the time to comment. Appreciate your thoughts.